Fuel Economy in Major Car Markets

Technology and Policy Drivers 2005-2017

About this report

Introduction

This report builds on a series of Global Fuel Economy Initiative (GFEI) 1 working papers investigating the fuel economy of newly registered 2 light-duty vehicles (LDVs) across the world from 2005 to 2017 3. The results are tracked relative to established GFEI targets, which are an intermediate target of 30% improvement of new LDV fuel economy, weighted globally, by 2020, and 50% by 2030.

The analysis builds on methodological improvements introduced in the previous GFEI report 4 5 6, and it maintains the broad country coverage that has characterised these analyses. Only Norway and Switzerland did not have additional data for 2016 and 2017. This report presents all the fuel consumption results calibrated to the Worldwide Harmonised Light-Duty Test Procedure (WLTP) 7 8.

Key elements of this report include:

- An assessment of LDV fuel economy progress from 2005 to 2017. It describes the main indicators in 2017 and evaluates progress in the previous two years as well as the twelve-year trend.

- Analysis of key developments of major drivers that influence fuel economy, outlining the status per country in 2017 and the twelve-year evolution of these variables for key regional groupings. These results are also considered in terms of expected progress towards the 2030 GFEI goals.

- A focus on LDV prices which aims to provide better insight into the costs of energy efficiency in the LDV market.

- A section investigating the main drivers of tested fuel economy in electrified vehicles.

- A special focus looking at the divergence between real driving fuel consumption and tested fuel economy of LDVs, and the corresponding compliance and enforcement aspects related to testing. It takes account of the evidence emerging from recent assessments 9 that show that the revision of test procedures, and, in particular, the introduction of the WLTP, enable only limited progress to match real driving fuel consumption values. This section discusses measures that can help narrow the gap.

The methodology adopted to develop the IEA-GFEI database underpinning the analysis is outlined in Annex A. Annex B gives details on the growing evidence of increasing gaps between on-road and tested fuel economy performance, and highlights compliance and enforcement frameworks in the major vehicle markets. Annex C includes statistical tables with data on new vehicle registrations, average grammes of carbon dioxide emissions per kilometre, fuel consumption, power, displacement, weight, footprint and price.

Scope

This study includes the new registrations of light-duty vehicles, a category defined as passenger cars, passenger light trucks and light-commercial vehicles below 3.5 tonnes. The countries included in this analysis are Argentina, Australia, Brazil, Canada, Chile, People's Republic of China, Egypt, most European countries (all countries in the European Union, the other countries in the European Economic Area [including Iceland, Norway and Switzerland], Former Yugoslav Republic of Macedonia, Turkey and Ukraine), India, Indonesia, Japan, Malaysia, Mexico, Peru, Philippines, Russian Federation, South Africa, Korea, Thailand and United States. Germany, France, Italy and United Kingdom are presented separately from the European Union, with more detailed information in several analyses. Due to data availability, not each country could be represented for all years in this analysis (coverage is available in Annex C).

Country database

Download the data sets

This report is accompanied by a set of 18 country-specific assessments containing information on key socio-economic indicators, brief outlines of the policy framework influencing vehicle fuel economy and graphs showing key vehicle characteristics over time. The country database also includes a detailed analysis of real driving vs. tested fuel economy, compliance and enforcement for the European Union countries, China, Japan and the United States.

Data tables covering 53 countries are also available for download in Excel format.

Key findings

Market status of new light-duty vehicles

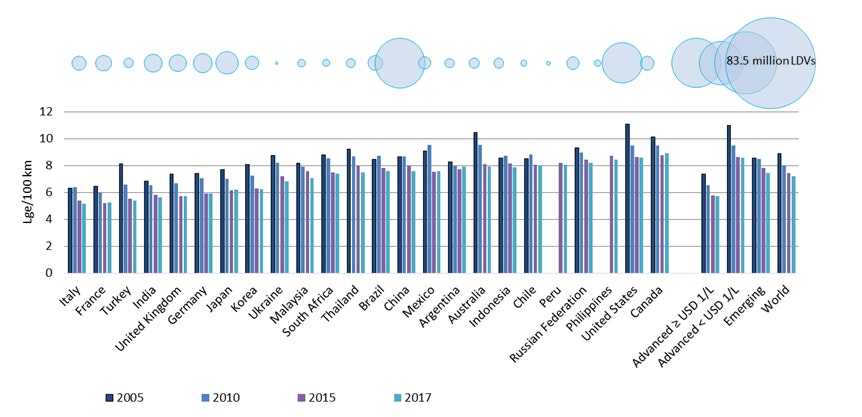

The global average fuel consumption of newly registered10 light-duty vehicles (LDVs) reached 7.2 litres of gasoline-equivalent per 100 kilometres (Lge/100 km) in 2017 within an LDV market where sales have grown by around 10% between 2015 and 2017 (Figure KF1). The average fuel consumption between countries differs substantially among countries, ranging between 5.2 Lge/100 km and 8.9 Lge/100 km.

Countries can be clustered in three main groups:

- Advanced economies with a gasoline price below USD 1/L - Australia, Canada and the United States, where average fuel consumption is in the 7.9 to 9 Lge/100 km range.

- Advanced economies with gasoline prices above USD 1/L - European Union11, Turkey, Japan and Korea, where fuel use per kilometre ranges between 5.2 and 6.5 Lge/100 km.

- Emerging economies, with average fuel consumption in the 6.5 to 8.5 Lge/100 km range, with India - which has a fuel consumption of 5.6 Lge/100 km - as an outlier.

Average LDV fuel economy improved in all regions between 2005 and 2017, though there is a wide divergence of absolute levels and trends between countries and regions

Figure KF1. Average new LDV fuel economy by country or region (2005-17) and new registrations (2017)

Notes: Circle size indicates number of vehicles sold. Fuel consumption measured in Lge/100 km, WLTP. Source: IEA elaboration and enhancement for broader coverage of IHS Markit database (IHS Markit, 2018).

The average fuel economy improvement rate between 2015 and 2017 slowed down to 1.4% per year, which is the lowest since the GFEI benchmarking started (Table KF1). This is one third of the required improvement rate (3.7% per year) to meet the 2030 GFEI target, owing to the lower improvement between 2005 and 2017. The reduction of the average fuel consumption per kilometre slowed down in advanced economies to only 0.2% per year, on average, between 2015 and 2017, with more than 20 countries experiencing a reversal in the evolution of their fuel economy. In contrast, the improvement of fuel use per kilometre in emerging economies accelerated to 2.3%.

Annual improvement is slowing in advanced economies and accelerating in emerging economies. Both rates are below those needed to achieve the GFEI target

Table KF1. Progress in average fuel economy improvement in different regions and GFEI target for 2030

| 2005 | 2010 | 2015 | 2017 | 2005-2017 | 2030 | |||

|---|---|---|---|---|---|---|---|---|

|

Advanced (Gasoline price ≥ USD 1/L) |

Average fuel economy (Lge/100km) | 7.4 | 6.5 | 5.8 | 5.8 | |||

| Annual improvement rate | -2.4% | -2.5% | -0.1% | -2.0% | ||||

|

Advanced (Gasoline price < USD 1/L) |

Average fuel economy (Lge/100km) | 11.0 | 9.5 | 8.6 | 8.6 | |||

| Annual improvement rate | -2.9% | -1.9% | -0.4% | -2.0% | ||||

| Emerging | Average fuel economy (Lge/100km) | 8.6 | 8.5 | 7.8 | 7.5 | |||

| Annual improvement rate | -0.2% | -1.6% | -2.3% | -1.2% | ||||

| Global | Average fuel economy (Lge/100km) | 8.8 | 8.0 | 7.4 | 7.2 | |||

| Annual improvement rate | -2.0% | -1.5% | -1.4% | -1.7% | ||||

| GFEI target | Average fuel economy (Lge/100km) | 4.4 | ||||||

|

Required annual improvement rate (% per year) |

2005 base year | -2.8% | ||||||

| 2017 base year | -3.7% | |||||||

Source: IEA elaboration and enhancement for broader coverage of IHS Markit database (IHS Markit, 2018).

Drivers of recent fuel economy trends

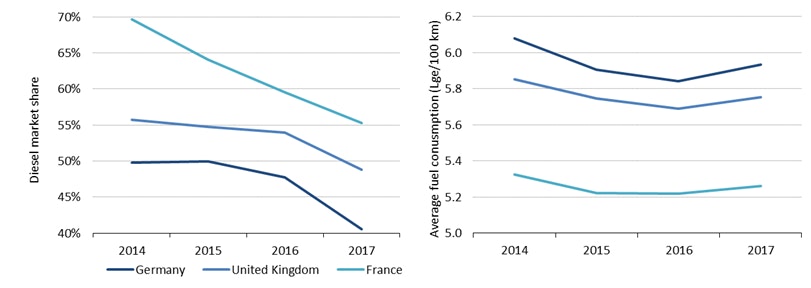

Key drivers of the recent developments of the average fuel consumption include the rapid decline of diesel sales in several major vehicle markets, most notably in Europe, the advanced economy with the greatest reliance on this powertrain technology (Figure KF2). Since 2015, diesel shares have fallen by 5-15 percentage points in the largest EU markets, a change that was not sufficiently counterbalanced by the 1-3 percentage point growth of electrified LDVs to maintain efficiency improvements over gasoline vehicles.

Countries with decreasing shares of diesel powertrains saw a worsening trend in average fuel consumption in 2016-17

Figure KF2. Dieselisation rate and average fuel consumption trends in selected countries, 2014-17

Source: IEA elaboration and enhancement for broader coverage of IHS Markit database (IHS Markit, 2018).

The growing consumer demand for larger vehicles – a characteristic that has been common to all vehicle markets despite ongoing efficiency improvements per vehicle segment – is also a major determinant of recent developments in the average fuel economy of LDVs (Figure KF2). The market share of sport utility vehicles (SUVs) and pick-ups has grown by 11 percentage points since 2014 and, in 2017, represented nearly 40% of the global LDV market. North America and Australia have had a particularly high market share of SUVs/pick-ups, closing in on 60% in 2017. Most of the growth has taken place in the small SUV/pick-up segment, which includes many cross-over versions of popular passenger cars.

Even if the average fuel consumption of each vehicle segment continues to improve, the overall average fuel consumption is affected by the growing market share of more energy intensive SUVs and pick-ups, taking place at the expense of more fuel efficient passenger car segments

Figure KF3. Global average market share per vehicle segment and average fuel consumption per segment, 2014-17

Source: IEA elaboration and enhancement for broader coverage of IHS Markit database (IHS Markit, 2018).

A third important, determining factor in recent global fuel economy developments is the shift in market structures of advanced economies. There has been a decline in the market share of North America (which has larger and, therefore, less efficient vehicles), and a subsequent growth of the relevance of markets characterised by the smaller and more efficient vehicles sold in Europe, Japan and Korea. This has been accompanied by a contextual increase, for emerging economies, of the relevance of the People's Republic of China ("China") - where fuel economy is subject to regulations requiring significant fuel economy improvements - and India, a market that has traditionally been characterised by large shares of small and fuel efficient cars.

Links between vehicle efficiency and other attributes and prices

Analysing vehicle prices against other attributes indicates that consumers are prepared to pay a significant price premium for vehicles belonging to large market segments (with higher mass and footprint) and for those having a high power rating. Changes in vehicle attributes such as power, weight or footprint can mitigate the risk of price increases that could be induced by the increased adoption of fuel efficient technologies. Diesels, hybrids and electric vehicles cost more than gasoline vehicles having similar attributes. In particular, battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) offer very large improvements in fuel consumption, but this was coupled with a significant price premium in 2017. However, vehicle prices need to be analysed in rather narrow groups of attributes such as power, market segment, and size in order to see the impact of changes in powertrain technologies. This suggests that the impact of powertrain choices on vehicle prices is lower than is the impact of changes in other vehicle attributes. When looking at vehicles in the same market segment, with similar power and size, and with the same powertrain type, fuel efficiency is not coupled with higher vehicle prices. The 25% most efficient vehicles cost 5-7% less than the average equivalent vehicle, and the average fuel economy improvements they deliver are between 0.6 and 0.8 Lge/100 km. The analysis of vehicle prices also shows that small vehicles are cheaper in emerging economies than in advanced countries, and that this is not the case for large segments.

The role of policy

A growing amount of evidence highlights the importance of policies to improve average fuel consumption (Figure KF4). Countries with regulations and/or efficiency-based purchase incentives in place improved on average 60% faster than countries without such policies. The higher improvement rate is also reflected by the higher market share of electrified LDVs (hybrids, PHEVs, BEVs and fuel cell electric vehicles). Even if none of the countries with policies in place experienced fuel economy improvements fast enough to keep up with the 2030 GFEI target of halving the average fuel use per kilometre by 2030 (against a 2005 benchmark), several markets require improvement rates that are in line with it. The scope of existing fuel economy regulations is limited to the next few years in nearly all cases. Standards in North America range between 2018 and 2025, whereas no Asian country has a standard beyond 2022. Europe is the only region that defined fuel economy improvements reaching to the year 2030

Yearly improvement rates for fuel consumption are higher in countries with regulations or incentives. Nearly no countries or regions are on track to meet the 2030 GFEI target

Figure KF4. Average annual fuel economy improvement rates for selected countries with and without fuel economy regulations between 2012 and 2017

Notes: Regulated countries are Canada, China, European Union, India, Japan, Mexico, Korea and the United States. Source: IEA elaboration and enhancement for broader coverage of IHS Markit database (IHS Markit, 2018); (Transportpolicy.net, 2018a); (IEA, 2018b); (ICCT, 2018c).Countries without regulations but with incentives are Australia, Brazil, Chile, Malaysia, South Africa, Thailand and Turkey. Countries without incentives and regulations are Argentina, Egypt, Indonesia, Peru, Philippines, Russian Federation and Ukraine. Values are weighted based on vehicle sales in 2017. Incentives are efficiency-based taxes or subsidies for vehicle purchase on a national level. Alternative powertrains are hybrids, PHEVs and BEVs.

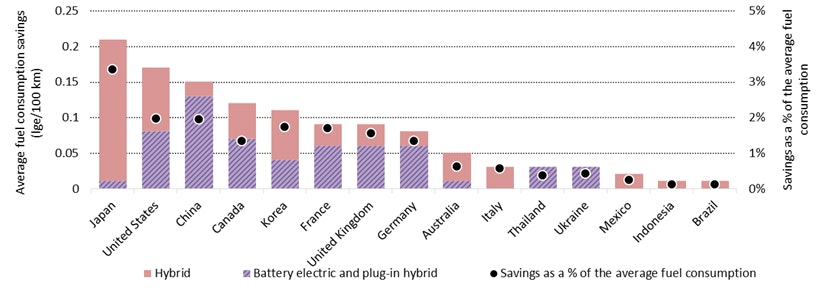

Focus on electrification

The electrification of LDVs is going to be crucial to ensure that fuel economy can be effectively improved, especially if diesel shares keep falling (Figure KF5). Electrified vehicles are already contributing positively to improve the country-weighted average fuel consumption by up to 3.5%. Japan experienced the largest gains due having to the largest market share globally for hybrids, followed by the United States with a mix of electrified vehicle types (HEV, BEV and PHEV). Electrification in China was also very relevant to improve the average fuel economy, thanks to a fast-growing market share for BEVs and PHEVs. Countries that currently have high average fuel consumption values (which typically go hand in hand with high shares of large and heavy vehicles) can benefit the most from electrification since electrified vehicle efficiency is less dependent on size and weight.

The largest fuel economy benefits from electrification in 2017 were experienced by Japan, the United States and China

Figure KF5. Contribution to the fuel consumption savings from electrified vehicles, 2017

Notes: Savings are calculated by substituting electrified vehicles, in each market segment and power class, by vehicles characterised by the average fuel use of the market segment and power class. Source: IEA elaboration and enhancement for broader coverage of IHS Markit database (IHS Markit, 2018).

Real-world fuel economy gap

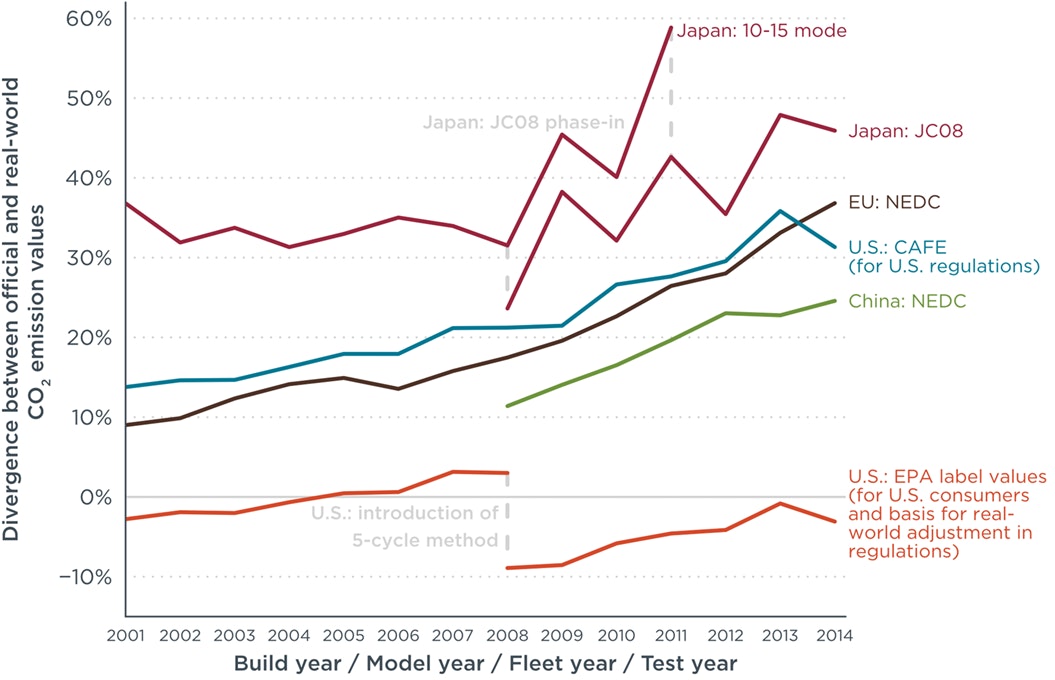

The gap between fuel consumption measured according to test values and in real-driving conditions grew over the past decade in most vehicle markets to reach values in 2017 that in some cases were almost 50% higher than the tested fuel consumption per kilometre (Figure KF6)

All key vehicle markets except for the United States show a gap of more than 10% between laboratory tested and real-world fuel consumption, which diverged to as high as 50% by 2014

Figure KF6. Divergence between official and real-world CO2 emission values for selected countries, 2001 14

Source: Tietge et al. (2017).

Compliance and enforcement policies help achieve a more realistic representation of fuel economy in real world conditions. Most major vehicle markets have started to take action to develop these measures and currently have varying types of compliance policies in place, whereas enforcement policies are less abundant. The United States has the most comprehensive policy framework to ensure well-functioning compliance and enforcement.

Policy recommendations

Meeting the 2030 GFEI target at the global level requires a widespread adoption of regulatory policies setting requirements for the improvement of fuel economies over time, combined with fiscal instruments to stimulate consumer demand for the vehicle technologies that offer the best performance. Long-term commitments are important to ensure that the investments necessary to deploy electrification technologies, which are crucial to meeting the GFEI targets in a phase where consumers are losing confidence in diesel, can take place. Tightening the rules governing the measurement of fuel consumption during tests, combined with measures capable of safeguarding on-road compliance, are essential to ensure that all stakeholders take effective action to meet the policy goals