Trucks and Buses

Why are trucks and buses important?

Tailpipe CO2 emissions from heavy-duty vehicles have been increasing rapidly since 2000, with trucks accounting for more than 80% of this growth. Vehicle efficiency standards, together with efforts to improve logistics and operational efficiency, are needed to slow growing emissions.

Where do we need to go?

Heavy-duty vehicles emissions need to peak rapidly and start declining in the coming decade to reach Net Zero Scenario milestones. More countries need to adopt, strengthen and harmonise heavy-duty vehicle fuel economy standards and zero-emission vehicle mandates. Electric and hydrogen fuel-cell electric heavy-duty vehicles need to be adopted now to enable emissions reductions in the 2020s and 2030s.

What are the challenges?

Decarbonising trucks via electrification requires additional renewable electricity supply, which may necessitate extensive upgrades to grid infrastructure. It also requires improved batteries to cope with the greater weight and range of trucks. The costs and lead times of these developments have the potential to hamper progress.

Tracking Trucks and Buses

Although they represent fewer than 8% of vehicles (excluding two- and three-wheelers), trucks and buses are responsible for more than 35% of direct CO2 emissions from road transport. Emissions in this sector are continuing to grow and have this year rebounded to around their 2019 level.

Promising increases in electric bus deployment, and recent stringent CO2 standards in the European Union and United States, will help to enable the rapid electrification required to decarbonise the sector. However, advances will be needed worldwide to reverse the trend of increasing emissions. To align with the Net Zero Emissions by 2050 (NZE) Scenario, emissions must fall by 15% by 2030 relative to their current level, declining at roughly 2% per year.

More than 90% of the world’s zero-emission buses and trucks are in China, but recent policies may help the European Union and United States catch up

Countries and regions making notable progress in decarbonising trucks and buses include the following:

- China continues to lead on deployment of electric buses and trucks, with more than 80% of global electric bus sales and over 85% of global electric truck sales in 2022.

- In February 2023, the European Union proposed ambitious CO2 standards for most new trucks and coaches (90% emissions reduction by 2040) and urban buses (100% zero-emission city bus sales by 2030).

- The United States announced substantial new funding for zero-emission buses and trucks in 2022 under the Inflation Reduction Act, with programmes aimed at vehicle purchase, infrastructure development and training, as well as proposed GHG emissions standards that will promote zero-emission trucks and buses from 2027.

- Emerging markets and developing economies are increasingly implementing electric bus policies as cost-effective and equitable transport solutions. Policy examples from 2022 include Ghana, with a target of 16% of bus sales to be electric by 2030; Viet Nam, which will encourage new and existing bus stations to accommodate electrification by 2030; and Panama, with a target of 33% of bus stock to be electric by 2030.

Stronger fuel economy standards are needed to put emissions from trucks and buses on a declining trajectory

In 2022, emissions from trucks rebounded to around their pre-Covid-19 pandemic levels. Current trends suggest that bus and truck emissions will exceed historic highs in 2023, and that emissions will then continue to increase in the coming years, unless ambitious policy change is introduced.

Rapid adoption of zero-emission vehicles (ZEVs), including electric and hydrogen fuel cell electric heavy-duty vehicles (HDVs), will be needed to enable the 15% reduction in emissions needed by 2030 to put the sector on a trajectory compatible with the NZE Scenario. To achieve this, more countries will need to adopt, strengthen and harmonise HDV fuel economy standards.

Global CO2 emissions from trucks and buses in the Net Zero Scenario, 2000-2030

OpenGreater uptake of electrified vehicles is needed to offset the increase in energy demand

The share of energy from biofuels in the road sector increases from less than 5% today to 10% by 2030 in the NZE Scenario. Yet even as biofuels continue to penetrate the gasoline and diesel fuel pools, zero-emission buses and trucks will need to be rapidly deployed, as further increasing the share of biofuels sustainably will become difficult. Urban electric transit buses, in particular, are already technically viable and cost-competitive in many contexts, largely due to the efficiency advantages of electrified powertrains over traditional internal combustion engines (ICE), meaning they also reduce overall energy consumption.

Where practical, logistical improvements and modal shift to rail or ship can help reduce overall energy demand, but fuel shifts – and above all, a focus on direct electrification – are still needed to meet remaining energy demand. In the NZE Scenario, electricity, which currently accounts for less than 0.5% of sectoral energy, and hydrogen (which today has a negligible share), increase to around 6% and over 1% of sectoral energy respectively, by the end of this decade.

Global final energy demand for trucks and buses by fuel in the Net Zero Scenario, 2000-2030

OpenChina continues to account for the majority of electric bus and truck sales, but market share elsewhere is growing rapidly

Globally, sales of alternatively fuelled trucks and buses (including hybrids) grew by more than 25% between 2021 and 2022, with battery electric vehicles representing over 90% of those sold in 2022.

China continues to dominate sales, accounting for over 80% of electric buses, and over 85% of electric heavy-duty trucks in 2022. Despite a sharp drop in total truck sales in 2022 in China, electric truck sales rose by almost 40% in the same period. Outside of China, electric bus sales are growing rapidly, albeit from a much lower base, and have moved from overall market shares of just over 0.5% in 2021 to almost 1% in 2022, while electric truck sales more than tripled to a market share of just over 0.2%. This is driven not just by policy, but also by the increasing number of areas where electric HDVs can offer a lower total cost of ownership than their diesel counterparts, particularly urban transport in Europe and the United States.

The sales share of ICE powertrains in the HDV sector falls from almost 98% today to just over 50% by 2030 in the NZE Scenario. The remainder is made up of battery electric (32%), plug-in hybrid (7%), hybrid (4%), and fuel cell electric (3%) vehicles. At a fleet level, zero-emission buses comprise almost 25% of the total stock and zero-emission trucks more than 10% in 2030.

Global sales by technology for trucks and buses in the Net Zero Scenario, 2000-2030

OpenBattery technology is improving, while the development and demonstration of heavy-duty ZEVs accelerates

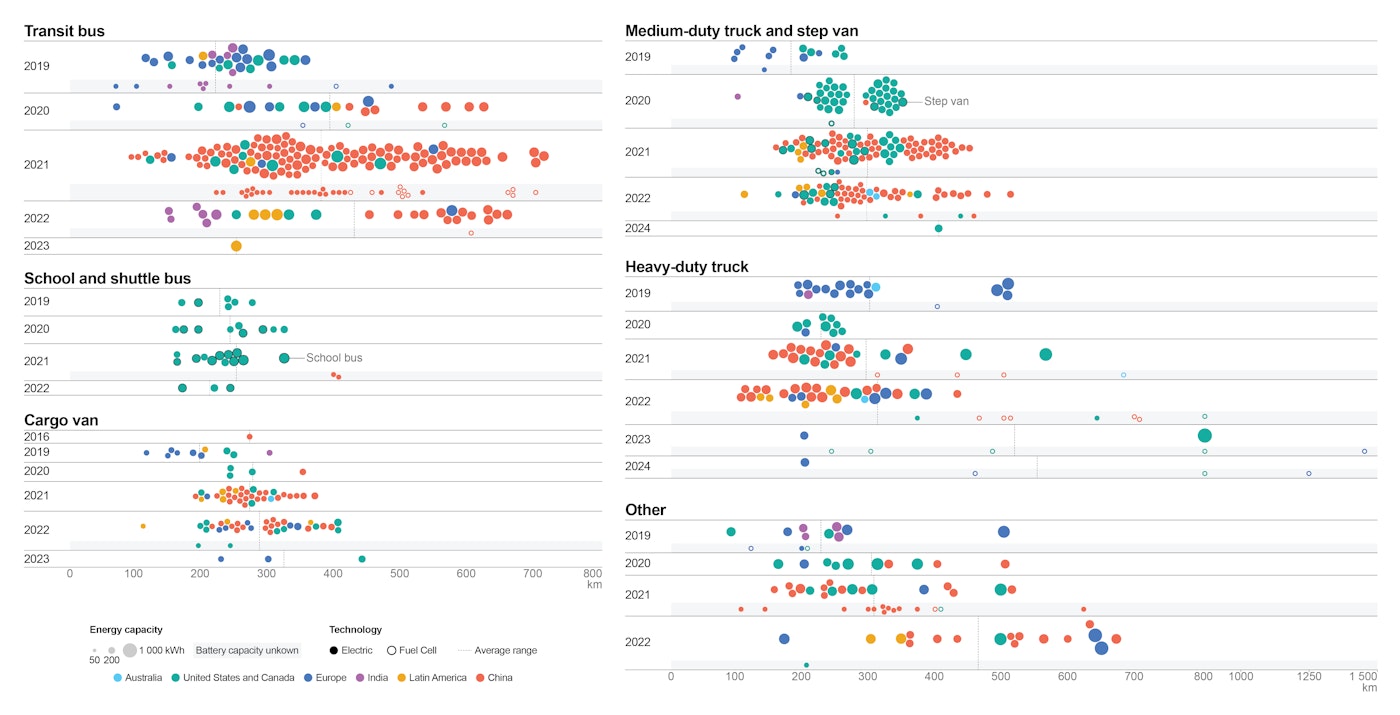

To date, buses have been the most amenable category of HDV to electrification; however, as manufacturers scale up production and battery technology improves in terms of cost, energy density and durability, the availability of electric truck models is also increasing. CALSTART, a United States-based non-profit think-tank focusing on transport policy and technology, provides details on current and announced models through their Global Drive to Zero ZETI tool.

The market is particularly dynamic in China, where zero-emission truck and bus manufacturers are developing and commercialising new models to satisfy domestic and international demand.

Current and announced zero-emission commercial vehicle models by type, release date and range, 2019-2023

Open

For more information

Charging and refuelling infrastructure is being developed, but improvements to the electrical grid are also essential

Work on developing standards for megawatt-scale electric vehicle charging systems needed to deploy electric trucks and buses in regional, long-haul, and intercity operations is ongoing at CHAdeMO in Asia, the US National Renewable Energy Laboratory (NREL) and at CharIN, a global group developing the Megawatt Charging System of up to 3.75 MW. Meanwhile, in 2022 NREL demonstrated high-flow-rate hydrogen fuelling at a test station mimicking heavy-duty vehicle refuelling, achieving the project milestone of completing a 60-80 kg hydrogen fill in under 10 minutes.

In order to decarbonise trucks via electrification, extensive upgrades to the associated grid infrastructure will also be needed, as well as additional renewable electricity supply. Co-ordinated and sustained investment is needed so that the potentially high costs and long lead times do not hamper progress.

Alternatives to fast charging are being demonstrated in various parts of the world. China leads the way on battery swapping, with a number of pilots underway and joint projects between GCL Energy Technology and Deepway Technology. Europe is leading on the development of electric road systems, where Germany has various demonstrations and Sweden is planning to build its first permanent system with a length of 21 km, aiming for this to be operational by 2025; demonstrations have also been announced in the United States and the United Kingdom.

Governments are tightening greenhouse gas and/or CO2 standards, and announcing ambitious ZEV deployment targets

Over 70% of HDVs sold in 2022 were covered by fuel economy or vehicle efficiency regulations, up from 60% in 2017, but down from a peak of 80% in 2020 as a result of sales increasing in countries with no such policies.

In the European Union, an emissions trading scheme for transport and proposed changes to the Alternative Fuels Infrastructure Regulation will aid heavy-duty ZEV deployment. A particularly important push will come from the revisions to the CO2 emissions standards covering the vast majority of HDV sales and emissions, first proposed in February 2023, which call for sales fleet average reductions of 45% by 2030, 65% by 2035, and 90% by 2040 relative to 2019.

In the United States, proposed GHG standards for HDVs could mean that 50% of vocational vehicles (including buses), 34% of day cab tractors (short- to-medium haul), and 25% of sleep cab tractors (long-haul) sold would be ZEVs in 2032. At a state level the Advanced Clean Fleets and Advanced Clean Trucks programs further promote ZEVs.

In China, national incentives for ZEV trucks and buses ended in 2022 after being introduced in 2015 and gradually reduced since 2017. These incentives successfully contributed to the adoption of almost 650 000 ZEV buses and just under 300 000 ZEV trucks in China.

Though many countries are setting ambitious targets, advanced economies could follow the lead of the European Union, United States, and China, and introduce combinations of regulation and incentives to tackle HDV CO2 emissions. Recent reports by CALSTART and the ICCT provide further details on ZEV policies in the HDV sector.

View all road transport policies

Collaborative efforts are underway to establish global standards and protocols for heavy-duty ZEV infrastructure

Collaboration across leading markets on heavy-duty ZEV infrastructure is critical for encouraging these vehicles’ innovation, accelerating their production and facilitating their adoption. It is also essential for establishing the interoperability of electric vehicle chargers.

At the time of writing, 27 countries – accounting for just over 15% of HDV sales – have endorsed the Global Memorandum of Understanding (MoU) on Zero-Emission Medium and Heavy-Duty Vehicles. Eleven countries signed the MoU in the past year, including the United States. Its ambition is for 30% of new truck and bus sales to be ZEVs by 2030 and 100% by 2040, adding to the push for ZEV deployment in the HDV sector.

The Hydrogen Heavy Duty Vehicle Industry Group seeks to develop global-standard high-flow hydrogen fuelling hardware components, while the PRHYDE project has developed a series of hydrogen fuelling protocols for acceptance into international standards, publishing the results in April 2023.

Several large original equipment manufacturers have made commitments that will accelerate the push for net zero

Launched in 2022, EV100+ signatories have committed to only procure ZEVs by 2030 and then fully transition their fleet of vehicles over 7.5 t to zero-emission by 2040; founding members include IKEA and Unilever. The Fleet Electrification Coalition is using the power of demand aggregation to reduce the costs and barriers to widespread adoption of electric trucks, including vehicle purchase and infrastructure rollout. Similarly, the First Movers Coalition is committed to sustainable purchasing, driving adoption of ZEVs in transport. Finally, the European Clean Trucking Alliance push for stronger sustainable trucking policy.

Elsewhere, manufacturers, fleet operators, infrastructure providers, and others have signed CALSTART’s Drive to Zero pledge. This pledge commits to enabling and accelerating the growth of ZEVs with the “vision that zero-emission technology will be commercially viable by 2025 and dominate by 2040 in specific vehicle segments.” Truck and bus manufacturers are also recognising the need to kickstart investment in charging infrastructure, with one recent example being Milence, the independent joint venture established by Traton, Volvo, and Daimler in 2022, which aims to deploy more than 1 700 fast (300 to 350 kW) and ultra-fast (1 MW) charging points across Europe.

Of the largest HDV OEMs, 21 have made commitments to ZEVs and carbon reductions, ranging from a 90% reduction in CO2 emissions in driving operation by 2050, to 90% ZEV sales by 2040, and including 5 commitments to be free of fossil fuels by 2040. Many of these commitments focus on electrification.

We would like to thank the following external reviewers:

- Matteo Craglia, ITF

- Eamonn Mulholland, ICCT

Recommendations

Programmes and partnerships

The Future of Trucks

The road freight sector is both a key enabler of economic activity and a key source of energy demand, in particular oil.

Authors and contributors

Lead authors

Shane McDonagh

Contributors

Elizabeth Connelly

Jacob Teter

Recommendations